Improved trading station

I got a new PC and another 24" LED monitor. So I have two screens each with 1920x1200 resolution. One screen is for ladders and other for charts and betfair video. It allows me very quickly to pick charts what I want to trade and to see what is happening in whole market in just one glance. I think some pictures will do better than lots of words :)

Trading "corner"

Changing trading style

At the time I am changing my trading style from scalping to swinging (except very liquid races), because I think markets are getting more competitive, it gets very frustrating then markets start to play with you chase game while scalping, you must chase it to get your money matched for your entry and it is running away then you try to exit (bigger odds), of course in liquid markets it's not like this, but then you come at 7th minute and see only ~60k total matched probably you are looking for a trouble if you want to put your money for a quick scalp there. At the time I am trying to step out to a larger scale, I mean putting money earlier and waiting for bigger movements longer with bigger stop loss. Probably I got influenced to change trading style by a book what I am reading , "The Art & Science of Technical Analysis" by Adam Grimes.

In the beginning it was very hard psychologically, I wanted to be clicking a lot more in the ladders, and surviving pullbacks was a nightmare, lots of times I would predict swings, but no guts to be in them or I just exit too early, or I find places to make big losses somewhere else than my edges tells me to be and of course missing places where I should be. But with time it is getting easier, and I am improving this "waiting in the right place" and "clicking less in places with low profitability/probability".

Books and financial markets

Still reading trading related books, at the time I am waiting to be shipped for me "The Complete TurtleTrader: The Legend, the Lessons, the Results" and "The New Market Wizards" . My trading library is getting bigger :) I believe I got lots from books about trading what I have and I am sure I will be looking for more in the future.

Well, I am preparing myself not only for always changing and improving betfair pre race horse racing markets but for financial markets too, at the time I try to split my work week to 3 days for betfair and 3 days for learning tech analysis charting for financial markets. However there is always "something" in life and it's hard to stay with a schedule all the time. Tons of work waits me before I start to put real money on forex trading again, I need to make better preparation and it's very hard then there is another trading arena which requires big amounts of inside resources and time. But I believe I will make huge progress before next summer.

Power of clear goals

Last spring I made a goal "I should make 150eu daily this summer at least for one month". And it came true :) I made two months better than 150eu average daily, which was my dream from the start of my bf trading carrier. However earnings dropped dramatically in August. But it remembers me that having a clear well defined goals makes magic. My "big" next goals for horses will be set only next spring, because I think it's not a good idea to setup them right now then things is coming slower in the winter. My goals for forex trading is not killers either yet too : "define exactly your edges on the paper", "make research with your edges (make sure you do have an edge at all)", "read all the books what I have", "start to trade demo, and if it will be successful start to do trade real money slowly."

Psychology and top performance

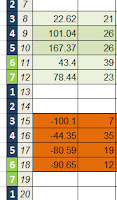

I still need more consistency, because I had some very bad weeks, however not a single loosing month since February. At these harsh times it seems I forget how to trade, and markets seems very unreadable, but I believe there are problems inside me rather than in the markets. I think my trading performance drops dramatically then I am not feeling good physically, or I am tired, or I am in the bad mood, or have other not so big frustrating life issues. In short then I am not in my top performance, my PL sucks... and it sucks big! Here are an example of two trading weeks in August, where one week suffers from "not top performance"

I like to compare this with other high performance things. Like driving a sport car in a race. Can you expect to finish in the first place when you are disturbed, or not concentrated, or ill, or frustrated, or tired? I think no ...

Big loss from a thin air! These losses drives me crazy...

Was trading IRE racing market, entered pre race in the back side on the horse about 30 odd, exited most of the stake before off, and remaining in the inplay abut 30s from the start. Made few bucks. Closed position and made sure there is no stakes left in the ladder and everything is green like always. After 10 minutes I noticed that I am missing 300eu ! My pl shows that -300 too. So happened this :

Please note that there was a late non-runner in this race and as such any bets that were matched before the off of the race and before the non-runner was announced will have a reduction factor applied to the bet. Any bets that are matched after the off of the race do not have the reduction factor applied to them as the price reflects what is happening within the market and the race. These bets have been settled correctly on the account and unfortunately this has resulted in a loss on the bets you have placed.

That sucks! I hate this. So my entry was reduced by ~35% reduction factor and my exit was not, and that small remainder from a lay side on the horse ~30 odd won... I even did not know about non runner in this race!

It happened for me like this not a first time then bf takes money for me not fair. Imagine this, entry: back bet, exit: very late lay bet, and that one for some reason I don't know was voided lay bet :) so I lost about ~150.

Or this one: was clicking on a ladder and made too much multiple clicks and my account went to MINUS somehow, so I was sitting there with about -20 euros in my balance before 1m left to the start and without possibility to exit my ~200euros back bet, and of course I lost it... Bf said its very rare event, but these kind of shit happens.

Conclusion

By the way, there is my PL in August and September, still it looks like going in the right direction, hovewer variance is too big and I need to work on that.

So that's it for today, good luck!